everett wa sales tax calculator

Washington has a 65 statewide sales tax rate but also has 105 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2368 on. To calculate sales and use tax only.

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

To calculate sales and use tax only.

. Penalties and interest are due if tax forms are not filed and taxes are not paid by the due date. Retail Sales and Use Tax. 89 open jobs for Sales tax in Everett.

For example for a taxable gross revenue amount of. Meet the car finance team at our Mitsubishi dealer near Everett WA. With local taxes the total sales tax rate is between 7000 and 10500.

Did South Dakota v. The County sales tax rate is 0. In most states essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate.

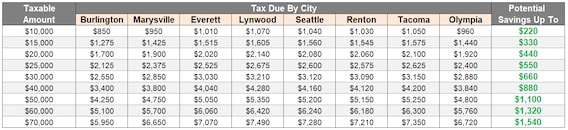

Youll find rates for sales and use tax motor vehicle taxes and lodging tax. With an 86 Sales Tax here in Burlington WA and start saving. It is comprised of a state component at 65 and a local component at 12 38.

Ad Lookup Sales Tax Rates For Free. The Sales and Use Tax is Washingtons principal revenue source. An alternative sales tax rate of 105 applies in the tax region Snohomish-Ptba which appertains to zip code 98204.

The largest increases were found in Transportation Food and Housing. See how we can help improve your knowledge of Math. This is multiplied by your gross receipts to compute your taxes due.

Sales Tax State Local Sales Tax on Food. 98201 98203 98206 98207 and 98213. Let us help you make an informed decision about.

A retail sale is the sale of tangible personal property. The motor vehicle saleslease tax also applies when use tax is due on demonstration executive and service vehicles. Sales Tax State Local Sales Tax on Food.

The Everett sales tax rate is 34. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington. Search Sales tax jobs in Everett WA with company ratings salaries.

Everett WA area prices were up 29 from a year ago. Everett in Washington has a tax rate of 97 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Everett totaling 32. The Everett Washington Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Everett Washington in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Everett Washington.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Search by address zip plus four or use the map to find the rate for a specific location. The minimum combined 2022 sales tax rate for Everett Washington is 99.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Everett WA. The Everett Washington sales tax is 970 consisting of 650 Washington state sales tax and 320 Everett local sales taxesThe local sales tax consists of a 320 city sales tax. Decimal degrees between -1250 and -116.

Use this search tool to look up sales tax rates for any location in Washington. The Everett Washington sales tax rate of 99 applies to the following five zip codes. The Washington sales tax rate is currently 65.

One of a suite of free online calculators provided by the team at iCalculator. The present tax rate is 01 0001. Business and Occupation Tax Rate.

Washington has recent rate changes Thu Jul 01 2021. Used Inventory Used Vehicles. Special reporting instructions for sales or leases of motor vehicles RCW 8214450 4 provides an exemption from the public safety component of the retail sales tax approved by voters in a city or county.

You can find more tax rates and allowances for Everett and Washington in the 2022 Washington Tax Tables. You can find more tax rates and allowances for Everett and Washington in the 2022 Washington Tax Tables. The current total local sales tax rate in Everett WA is 9800.

Real property tax on median home. Used Vehicles Vehicles Under 10k Pre-Auction Inventory. Washington WA Sales Tax Rates by City A The state sales tax rate in Washingtonis 6500.

Real property tax on median home. 36 rows Washington WA Sales Tax Rates by City E The state sales tax rate in Washington is 6500. 100000 the business pays 100.

Decimal degrees between 450 and 49005 Longitude. The local sales tax consists of a 3. The Everett Washington sales tax is 9.

The city of everett collects a number of special local taxes on specific types of business activity including the utility gambling and admission tax. Look up a tax rate. An alternative sales tax rate of 106 applies in the tax region Snohomish which appertains to zip code 98208.

The Everett Sales Tax is collected by the merchant on all qualifying sales made within Everett. Businesses making retail sales in Washington collect sales tax from their customer. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Total 77 103. Posted on January 20 2021 by January 20 2021 by. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Everett wa sales tax calculator. Groceries are exempt from the Everett and Washington state sales taxes. Helen Marrow Joins Tufts University faculty.

Payment Calculator CarFinder Shop By Model. This is the total of state county and city sales tax rates. Interactive Tax Map Unlimited Use.

The December 2020 total local sales tax rate was also 9800.

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Why Are Property Taxes Higher As A Percentage In Austin Than They Are Even In Seattle Quora

Washington Sales Tax Small Business Guide Truic

Why Tax Is Less In Washington Seattle Compared To California Quora

Auto Sales Tax Calculator Buy A Vw Near Marysville Wa

Washington Income Tax Calculator Smartasset

The Snohomish County Washington Local Sales Tax Rate Is A Minimum Of 6 5

What Is The Total State And Local Sales Tax Rate

Why Are Property Taxes Higher As A Percentage In Austin Than They Are Even In Seattle Quora

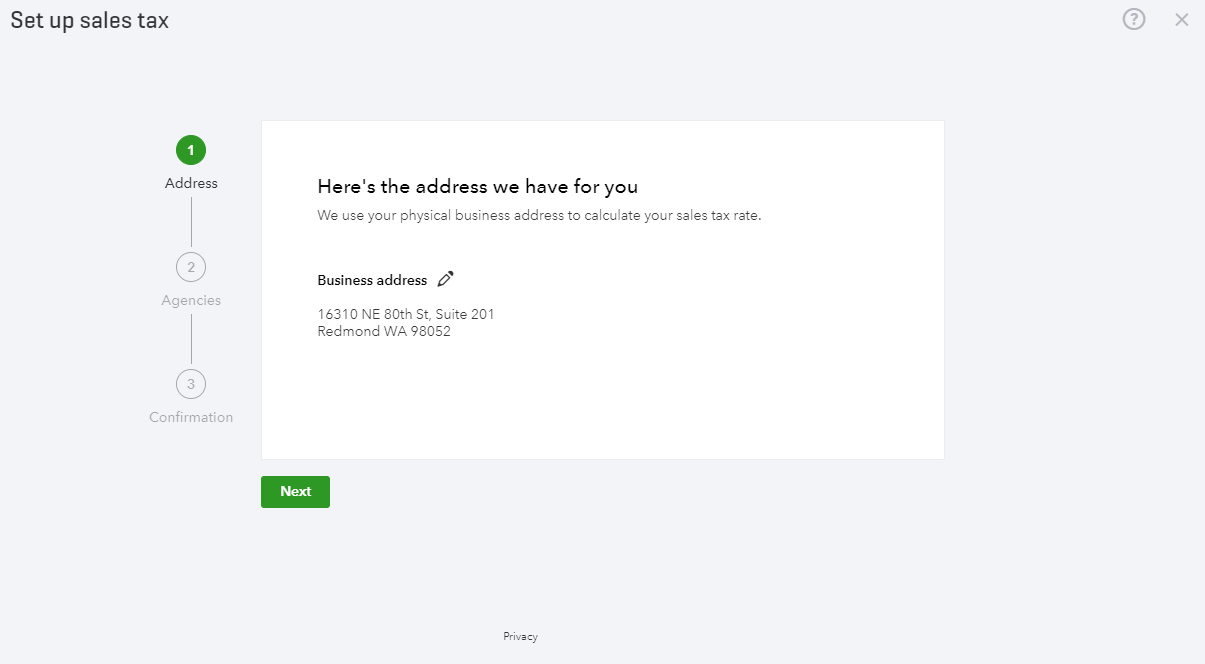

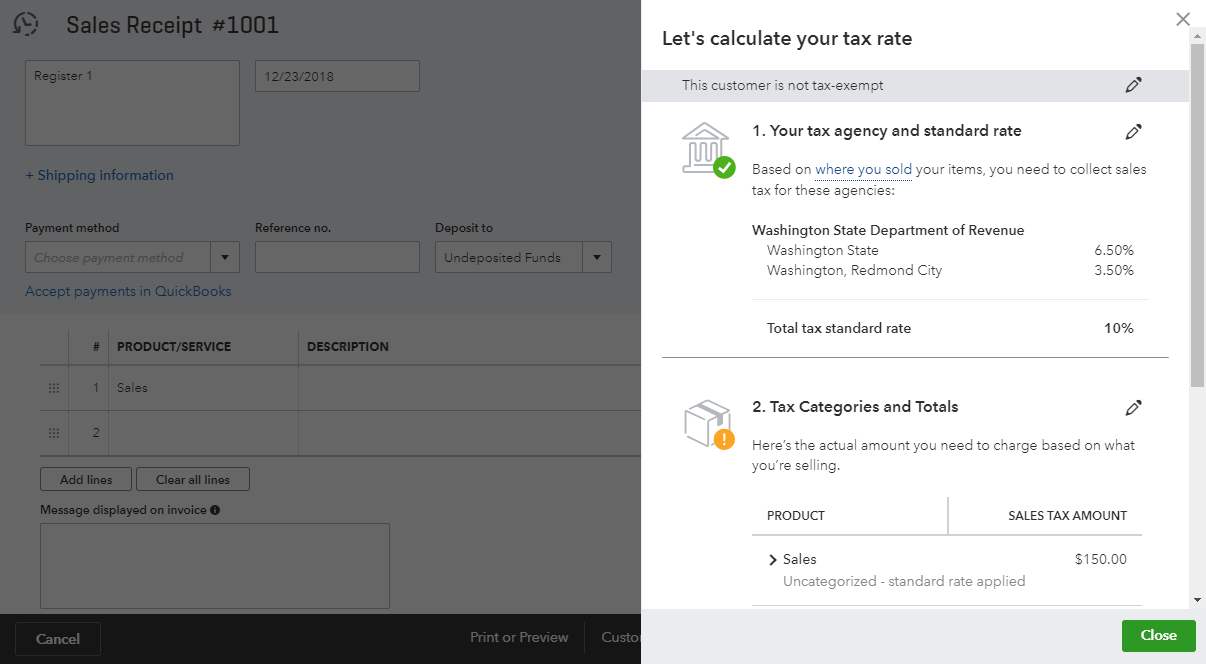

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

Washington Sales Tax Guide And Calculator 2022 Taxjar

Are Restaurants Cheating On Sales Taxes Crosscut

Washington Dc Sales Tax Calculator Reverse Sales Dremployee

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business