reit dividend tax philippines

The REIT Law has a special provision for overseas Filipino workers OFWS. Since sending out the alert above CIM-B rallied and MFA-C declined.

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

More so for OFWs who invest in Philippine REITs as theyre exempted from paying the 10 income tax or withholding tax on dividends for seven years starting from January 20.

. The gap between the two share prices currently 124 is still lower than average by historical. Since REITs are obliged by law to maintain 33 of the companys share to be owned by public investors and distribute a minimum of 90 of their taxable income to. From over a dozen.

Generally REITs are predicted to give between 4 to 6 in dividends every year. The savings may then be. Overseas Filipinos investing in local real estate investment trusts REITs will be exempted from income tax or withholding tax on dividends from this new asset class for the.

14 of Republic Act No. They also offer tax advantages for overseas Filipino investors as they dont need to pay dividend taxes for 7 years once REIT tax regulations are in place. It debuted in the Philippine Stock Exchange on March 23 2021 with.

Since REITs are required to regularly declare 90 of their distributable income as dividends this would result in substantially lower taxes on income. FILRT declared a cash dividend today barely a month since its successful debut on the Philippine Stock Exchange PSE. DDMP REIT Inc.

So to summarize the tax to be withheld on cash dividend income received by these individuals is as follows. Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to the story than that. Resident alien 10.

REITs in the Philippines. 9856 OFWs are exempted from paying the 10 percent dividend tax. In its meeting today.

Amount of Cash Dividend Per Share. Founded by Edgar Sia II. Filipino citizen 10.

Updated list of eligible REIT-eligible stock brokers in the Philippines. DDMPR The real estate investment trust of Double Dragon Inc. The Real Estate Investment Trust REIT Act of 2009 proposes several incentives for establishing these corporations in the country including tax exemptions on revenues and.

Newly listed Filinvest REIT Corp. The Real Estate Investment Trust REIT Act of 2009 proposes several incentives for establishing these corporations in the country including tax exemptions on revenues and shareholder.

How Is Income From Invits And Reits Taxed Capitalmind Better Investing

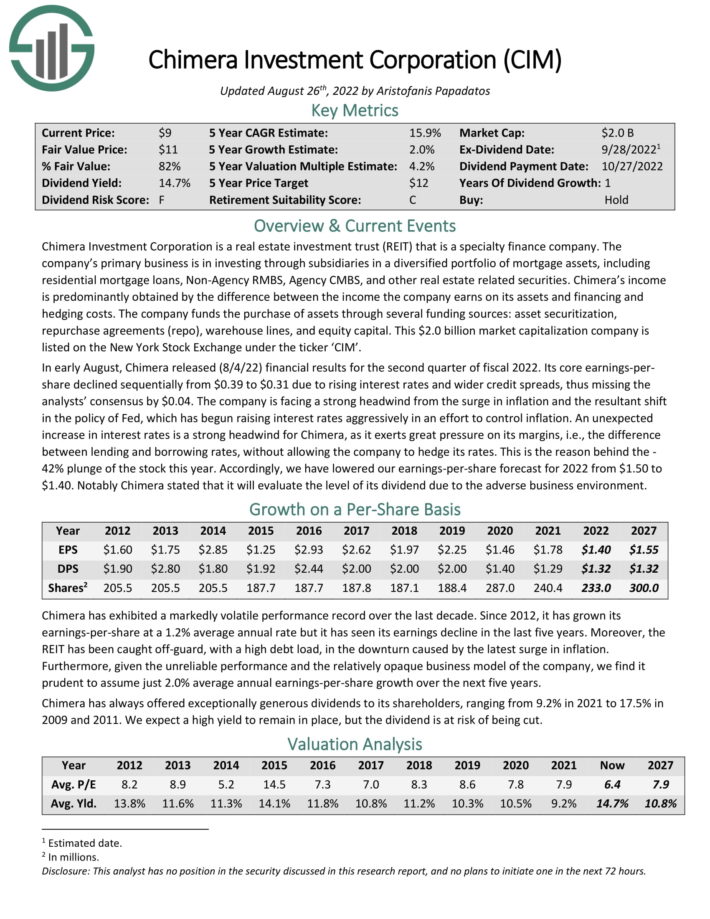

10 Super High Dividend Reits With Yields Up To 16 7

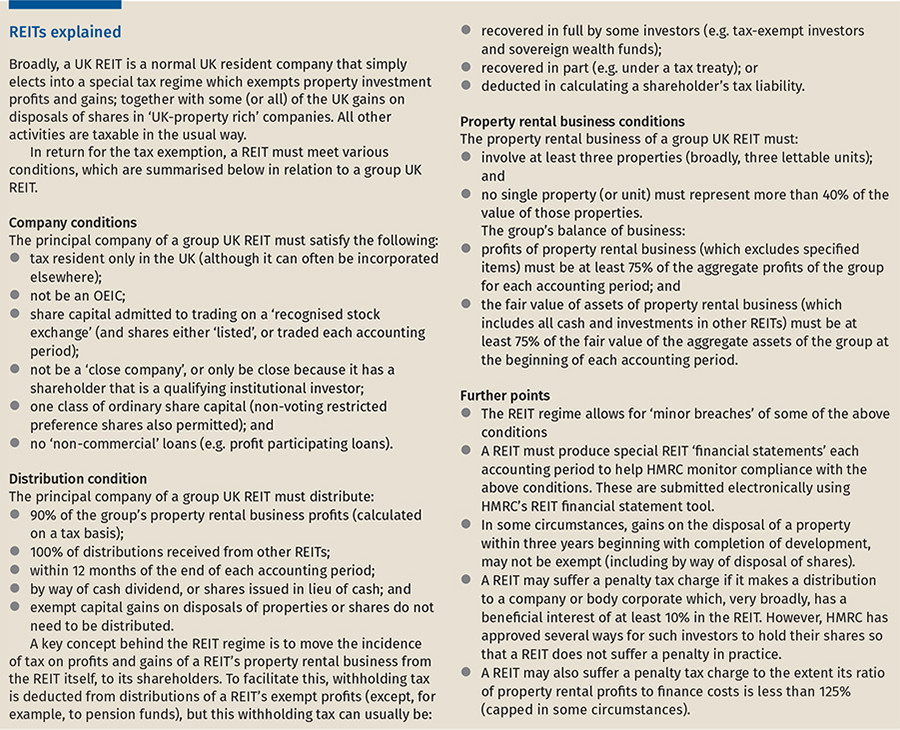

Taxation Of Reits Ringing In The Changes

Emergence Of Real Estate Investment Trust Reit In The Middle East

Philippine Reit Irr The Real Estate Group Philippines

Why Invest In Reits Benefits Of Reit Investing Nareit

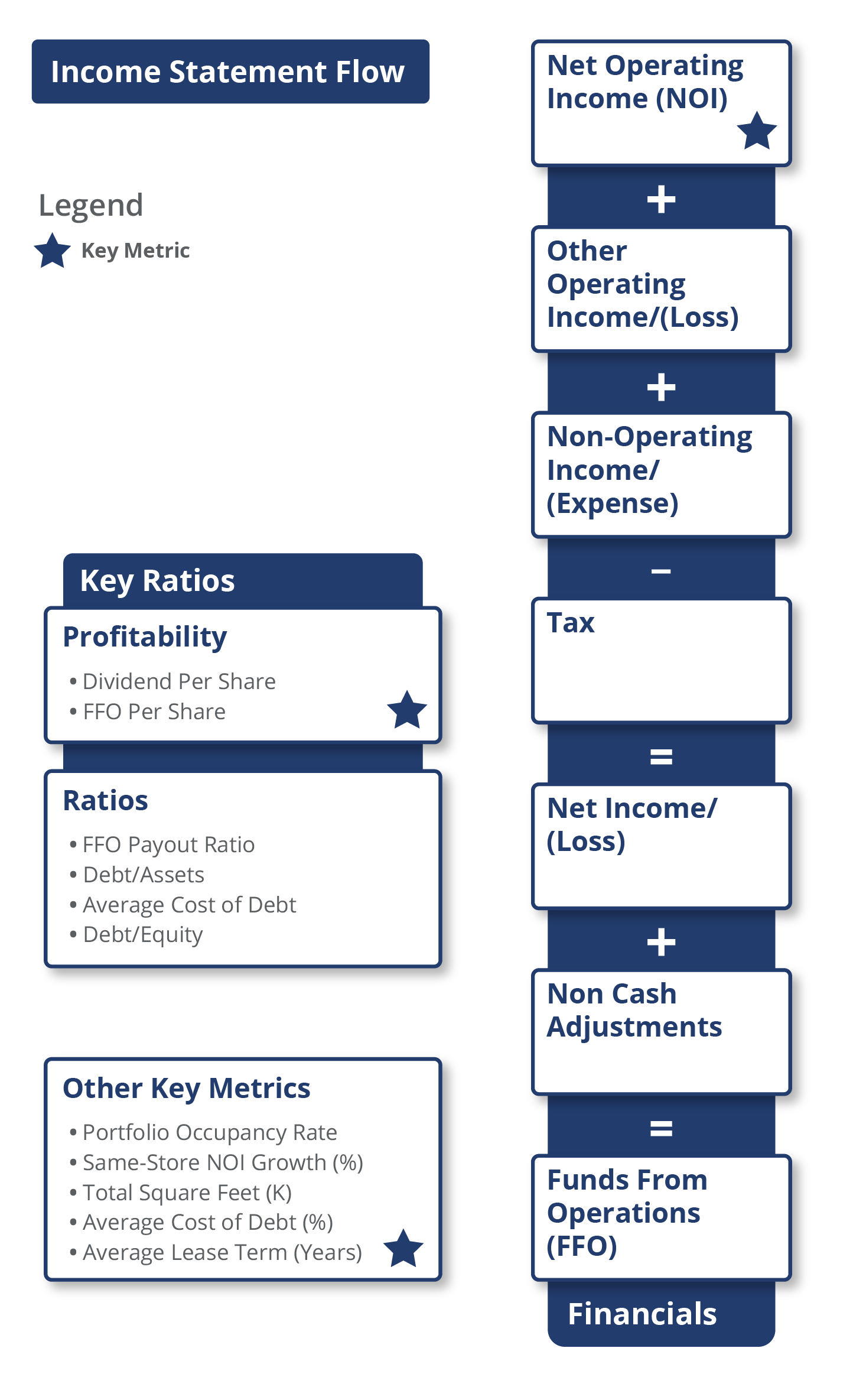

Guide To Retail Reits Industry Kpis Visible Alpha

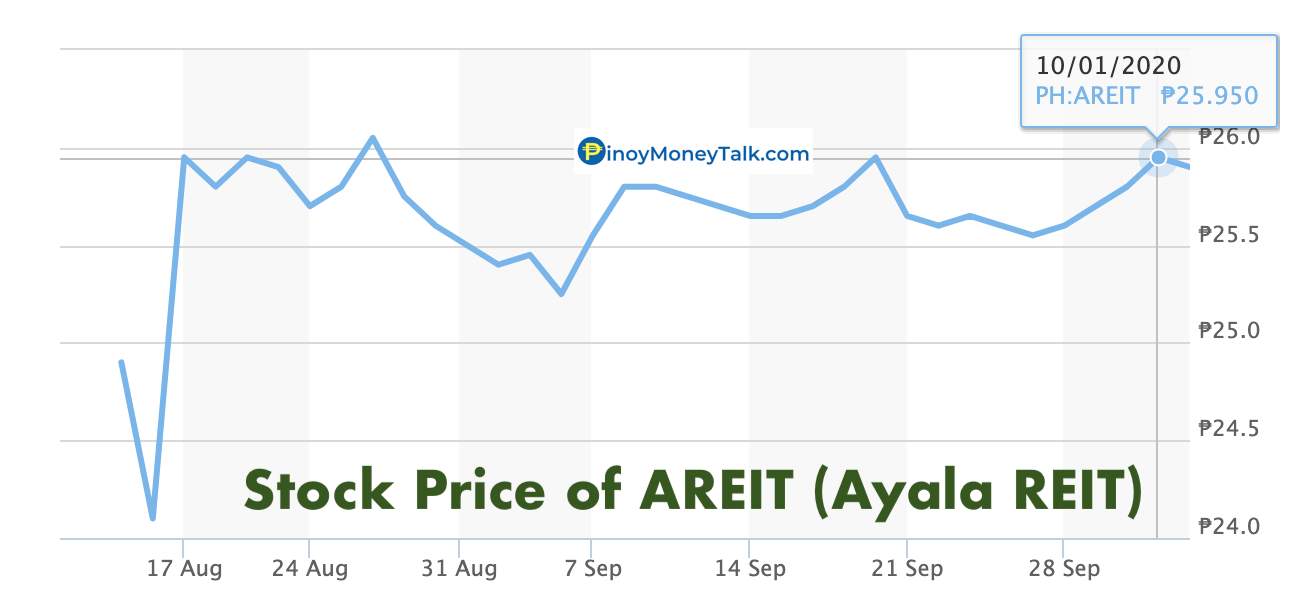

Areit Should You Buy The Stock Of Ayala Reit Pinoy Money Talk

Sec 199a And Subchapter M Rics Vs Reits

10 Super High Dividend Reits With Yields Up To 16 7

How Return Of Capital Can Enhance After Tax Etf Distributions Nasdaq

The Estate Tax On Stocks And Dividends

Reit National Tax Research Center Reit Philippines

Ranking The Best Passive Income Investments Financial Samurai

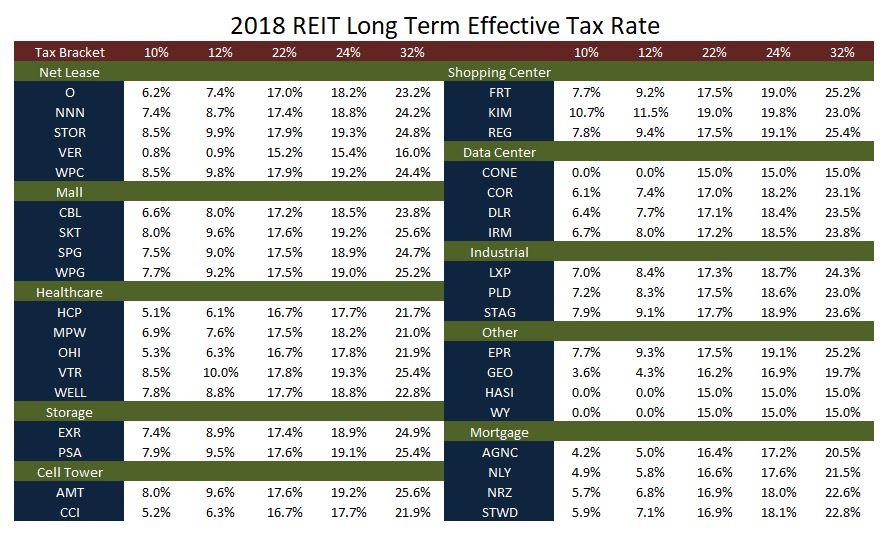

How Tax Efficient Are Your Reits Seeking Alpha

Why Don T More Reits Pay Monthly Dividends Seeking Alpha

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha